Table of Content

- Deductions allowed on home loan principal

- Income tax benefit on home loan under affordable housing explained

- Pocket Insurance

- Can I claim home loan tax benefit along with HRA?

- Tax Benefit for a Property Under Construction Loan

- Home Loan Interest Tax Benefits Under Section 24b Of Income Tax Act

- Deduction for Joint Home Loan

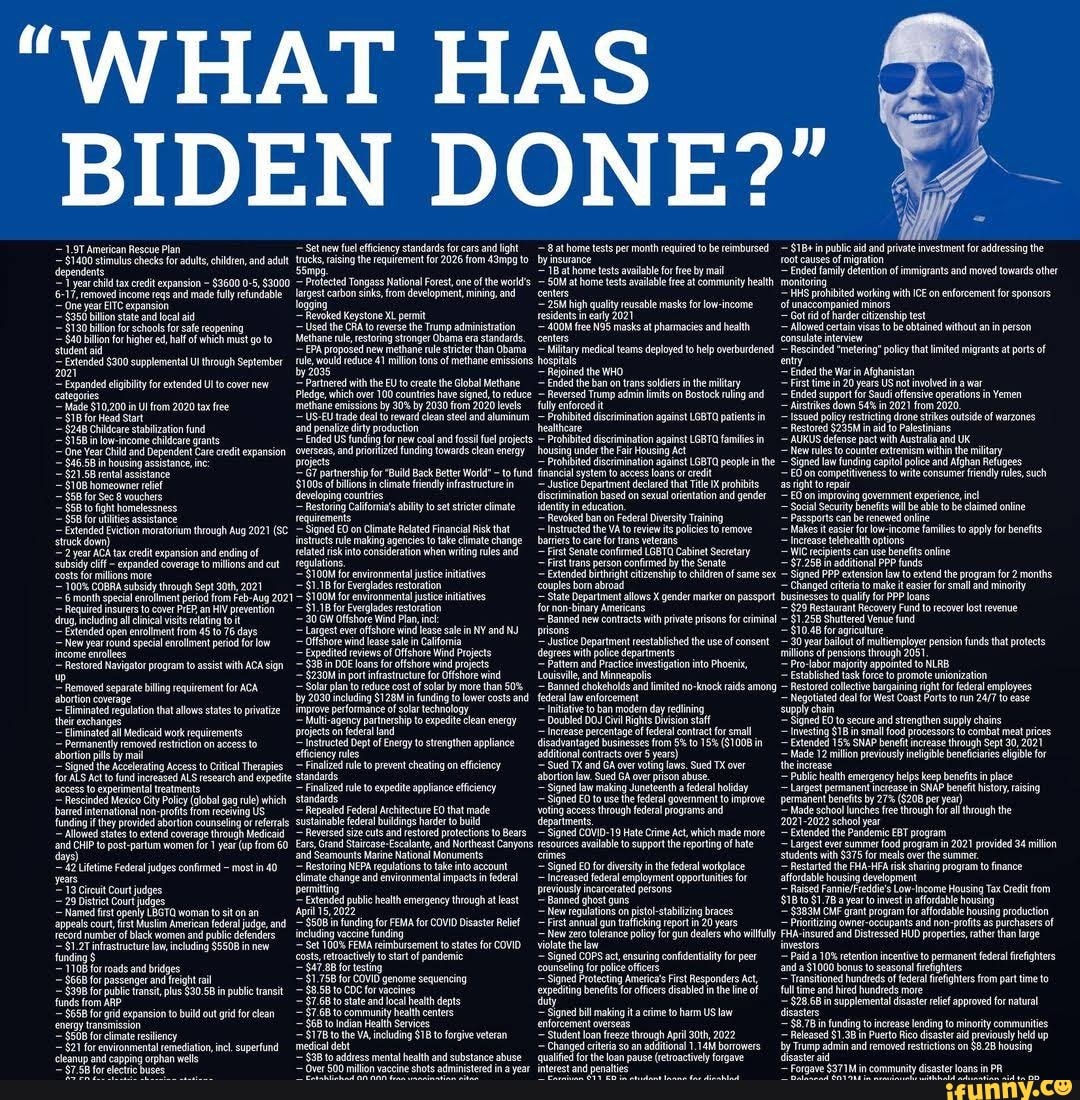

Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution. You can claim a Home Loan Interest Deduction of up to Rs. 50,000 per financial year as per this section. The deduction under 80EE is applicable only to individuals which means that if you are a HUF, AOP, a company, or any other kind of taxpayer, you cannot claim the benefit under this section.

Yes, on 1st February, 2021, in the Union Budget 2021 government extended the additional tax deduction of Rs. 1.5 lakh on interest paid on home loan for the purchase of affordable homes until March 31, 2022. The process to claim tax benefits on a home loan is easy and simple. The pre-construction interest on housing loan can be claimed in equal instalments in next 5 financial years after having taken possession of the property. Additionally, if the borrower sells his property within 5 years of taking the possession of the property, he cannot claim the 80C home loan deduction.

Deductions allowed on home loan principal

During the year, he has paid interest of Rs.2,50,000 on housing loan availed for both the houses. In such case, he can declare both the houses as self-occupied property in his income-tax return and claim benefit of interest paid on home loan to the extent of Rs.2,00,000 p.a. This benefit is no longer available to those applying for new home loans.

Buyers of a flat, a dwelling unit or a residential house property can claim the benefit. Significantly, the loan must be borrowed to buy a flat, a dwelling unit or a residential house property and not for reconstruction, repair, renovation, etc. From 1st April 2022, the government discontinued income tax deductions under Section 80EEA for first-time home buyers. Buyers will not be able to avail of tax benefits under Section 80EEA from 1st April 2022. However, those who got a housing loan sanctioned on or before 31 March 22 and bought a home or flat are eligible to avail deduction till the loan is fully repaid.

Income tax benefit on home loan under affordable housing explained

Section 24 also allows buyers to avail of deductions, even if the buyer has used fund from his own sources to make the purchase, without seeking any home loan. Under the section, a flat 30% deduction on the net annual value of a property is available to the owner, if the house is purchased entirely using the buyer’s personal funds. However, this rebate will not be available if the property is self-occupied, since such properties do n0t have any net annual value under the existing tax laws. Home buyers enjoy income tax benefits on both, the principal and interest component of the home loan under various sections of the Income Tax Act 1961.

Have all the loan- and property-related documents in place to avoid loan rejection. Calculate the overall cost of your loan – processing fee and other additional charges.

Pocket Insurance

Over and above the deduction you are ordinarily able to claim from your house property income, a deduction in five equal instalments beginning with the year the property is bought or construction is finished is permitted. The amount of money you will be saving on your home loan depends on different factors, such as ownership of the housing property. For a self-occupied property, there is a limit of Rs. 2 lakh under Section 24. Under Section 80C, you are eligible for deductions up to Rs. 1.5 lakhs and under Section 80 EE, deductions are limited to Rs. 50,000. Tax exemption is a basic calculation that considers your income, the principal amount of the loan, current tax implications, and interest rate.

The benefit under this section does not cover interest paid on home loan. Also, since Section 80EEA does not specify that the property must be self-occupied, you can claim the rebate on your rented or deemed-to-be-let-out property. When an individual opts for a home loan, the repayment is usually done by the Equated Monthly Installments . This EMI amount consists of a portion of both principal and interest amount. According to the Income Tax Act, an individual can enjoy tax benefits on both of these portions in a financial year.

Can I claim home loan tax benefit along with HRA?

You can claim tax benefits on a home loan when filing your income tax returns or when submitting the home loan interest certificate to your employer. The eligible tax deductions on home loans will be subtracted from your annual income. Needless to say, the overall tax will reduce with such deductions in place. Investors who buy and sell real estate can avoid paying capital gains taxes by investing through an IRA or any other self-directed retirement account. Another benefit for investors is the ability to avoid paying income tax on all rental receipts that are placed into a retirement account. For those who are looking to diversify beyond stocks and bonds, owning a rental property or two is a great way to accomplish that goal.

Section 80C of the IT Act makes provisions for yearly deductions of up to Rs.1.5 lakh towards principal repayment for both self-occupied and let-out properties. In order to claim this tax benefit, you should refrain from selling your property within the first 5 years of possession. If sold, your claims will be reversed in the year in which you sell the property.

Even if that is not the case and there is some scope for the tax payer to claim benefits towards home loan principal payment, it would be quite limited. To get additional tax rebates of up to Rs. 1.5 lakh under Section 80 EEA, you have to be a first-time homebuyer. Moreover, the stamp value of their property must not exceed Rs. 45 lakh. If you are self-employed, you do not need to submit these documents to claim your home loan tax deductions.

Any individual who has purchased a new property with a home loan can claim tax rebates under Section 80C, 24, 80EEA, 80EE of the Income Tax Act. Also, borrowers with a joint loan who are also co-owners of a property can claim tax rebates on housing credit. Individuals cannot claim tax benefits on home loan repayment till their property is fully constructed. However, that does not mean one cannot claim any tax benefit for the period of property construction. Taking a joint home loan by two or more applicants also has tax benefits.

Each can claim the home loan interest deduction under section 24b for a maximum amount of Rs.2 Lakhs per year. The following grid highlights the sections of the Income Tax Act that provide home loan rebate to the borrowers. Basically, these rules mean you can’t claim the deduction on an investment property, and you can’t claim it if you’re borrowing against your home equity to pay for college. Multiply this excess amount times your marginal tax rate to see how much the deduction saves you. These articles, the information therein and their other contents are for information purposes only.

Performance information may have changed since the time of publication. When you make money from selling something, the IRS generally wants a cut of your profits. That’s also true when you sell your home, but you’ll get a big chunk of any profit tax free if you’re lived in your home two of the last five years. You can deduct the interest you pay on up to $750,000 of mortgage debt ($375,000 if married filing separately). If your mortgage is $250,000, you don’t need to worry about this rule. If your mortgage is $1 million, be aware that you can’t deduct all your mortgage interest.

Additional tax benefits are also offered to first-time home buyers under Section 80EE and Section 80EEA. If you have taken loan to build a home, the construction work should be completed within 5 years of taking the home loan.2. In case that happens, any deductions that you have claimed will be added back to your income and taxed accordingly, in the assessment year in which the sale takes place.3. Deductions under Section 80C are offered on the payment basis – deductions can only be claimed on the actual amount the borrower pays in a year.

Therefore, a home loans is providing additional tax-saving options to the purchaser of house. However, the borrower needs to be very mindful of conditions prescribed under each section and documents required to substantiate the tax benefit availed under each section. Section 24 allows home buyers deductions of up to Rs 2 lakhs in a year towards interest payment.